Over the past decade, Nigeria’s real estate industry has quietly evolved from a land-flipping playground into a complex ecosystem of technology, innovation, and new investment models.

What used to be dominated by developers and land speculators is now being shaped by startups, young companies building real, scalable solutions to Nigeria’s most stubborn housing and infrastructure problems.

From flexible housing and digital co-ownership to hospitality-focused micro-lodges, these ventures are making real estate smarter, more inclusive, and more profitable for investors. Here are the top five real estate startups to watch in Nigeria in 2025, each offering a unique window into where the industry is headed.

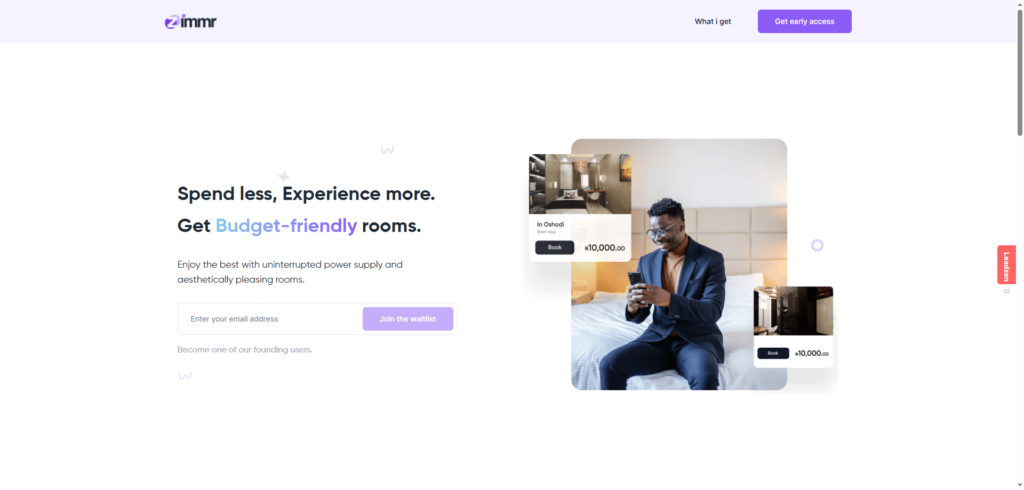

1. Zimmr — Turning Nigeria’s Travel Hubs into Profitable Real Estate Assets

When you think of real estate, the first images that come to mind are usually residential estates, office spaces, or short-let apartments. However, Zimmr challenges that idea completely.

Zimmr is pioneering a new category called “hospitality real estate”, which is a compact, affordable stay-and-work space built near Nigeria’s busiest interstate bus terminals.

The logic is simple: every day, thousands of business travelers arrive in Lagos from across Nigeria, but very few have safe, affordable, and decent lodging options near their arrival terminals.

What Makes Zimmr Different

Instead of building luxury hotels, Zimmr is creating micro-lodges strategically located in mobility hotspots like Oshodi and Ojota, where traffic from states like Ibadan, Abuja, and Port Harcourt converges.

Each facility offers:

- 11–20 comfortable bed spaces priced between ₦10,000–₦30,000 per night.

- Safe, tech-enabled check-ins for business travelers.

- Access to Wi-Fi, shared work areas, and light refreshments.

Zimmr’s Investment Snapshot

| Features | Details |

| Model | Hospitality real estate for business travelers |

| Location | Lagos (Oshodi, Ojota, Yaba Terminals) |

| Entry Cost | ₦1 million minimum |

| Project Value | ₦50 million (11-bed facility) |

| ROI Projection | Up to 10x in 5 years |

| Investment Deadline | January 2026 |

| Investor Access | Verified equity participation |

| Waitlist | 100+ early-stage business travelers and investors |

This model allows investors to own equity in physical, income-generating assets, not just speculative plots. With over 100 travelers already on Zimmr’s waitlist, and expansion plans across major terminals, the company is quietly positioning itself as Nigeria’s Airbnb for business travel.

“We’re not just building rooms,” says the Zimmr team, “we’re building a network of accessible travel spaces for Nigeria’s growing class of mobile professionals.”

For investors, it’s a rare chance to enter early into a cashflow-backed real estate segment with massive long-term potential.

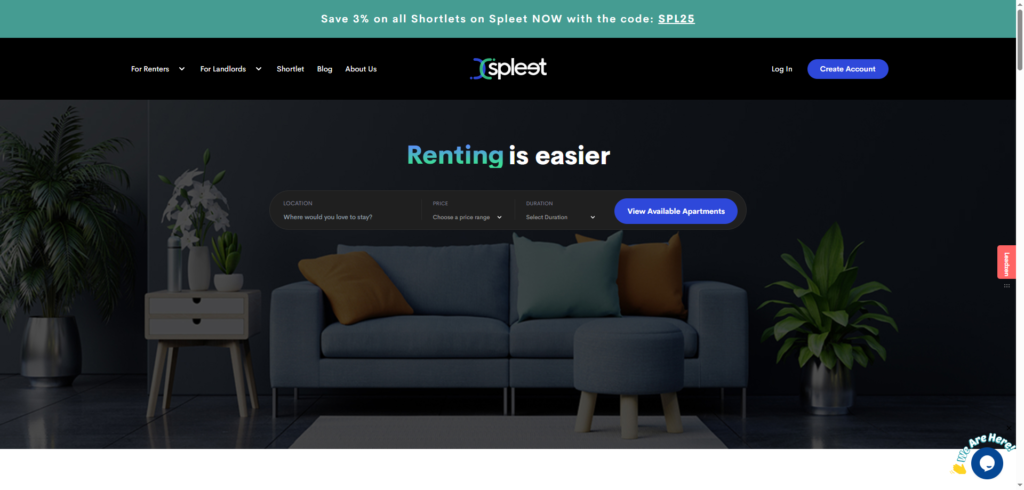

2. Spleet — Redefining Urban Housing for Nigeria’s Workforce

The rental crisis in Lagos is a known story, tenants paying a year’s rent upfront, with little flexibility or recourse. Spleet came along to change that narrative.

Spleet offers subscription-based housing that allows tenants to pay monthly, access vetted apartments, and manage rent digitally. For landlords, it reduces vacancy risks and ensures steady cashflow.

It’s a business model that has earned Spleet international recognition, including funding from major global accelerators, and established it as a pioneer in Nigeria’s PropTech-for-housing segment.

In many ways, Spleet represents the human side of real estate innovation , meeting the needs of a younger, mobile population that values flexibility and convenience.

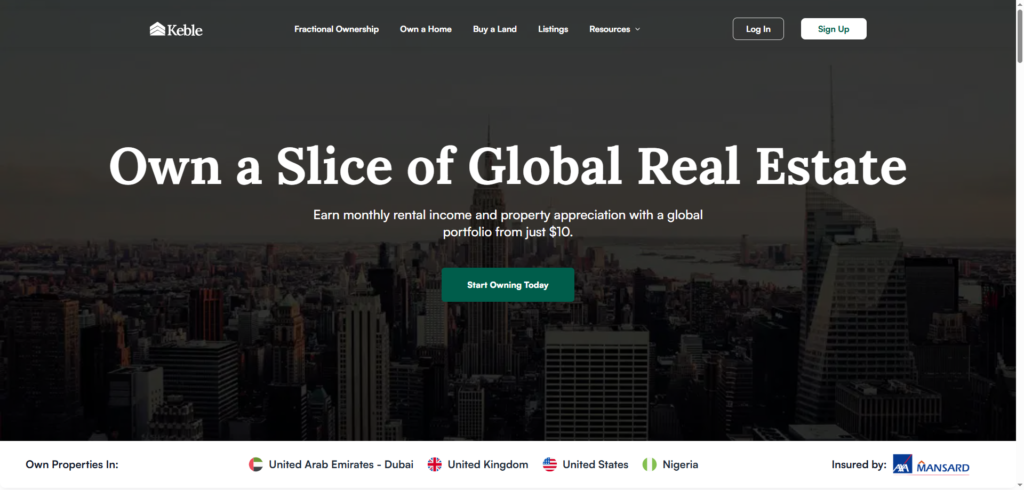

3. Keble — Investing in Real Estate Through Tokens

While crypto and real estate might seem like strange partners, Keble is proving otherwise.

The startup offers Nigerians the opportunity to own digital shares in real estate across Nigeria, Ghana, and even the UK, all backed by verified property assets.

By tokenizing ownership, Keble enables investors to diversify portfolios globally without navigating the paperwork or exchange rate barriers of traditional real estate.

With thousands of users onboarded, Keble is at the forefront of the blockchain-meets-bricks movement, a sector that’s only going to grow in relevance as African investors go more digital.

4. RentSmallSmall — Making Rent Payments Simpler, Safer, and Smarter

As one of the earliest players in Nigeria’s PropTech space, RentSmallSmall continues to solve one of the biggest urban pain points: rent affordability.

The platform connects tenants to verified landlords and allows monthly payment plans, bypassing the traditional one-year advance system.

For landlords, RentSmallSmall ensures consistent occupancy through pre-vetted tenants and guaranteed payments.

With over 20,000 rentals processed, the company has built a reputation for trust, accessibility, and genuine impact in the housing sector.

The Bigger Picture: Nigeria’s Real Estate Is Getting Smarter

What connects these five startups isn’t just innovation, it’s accessibility and sustainability.

They’re responding to three major shifts in Nigeria’s economy:

- A younger, more mobile workforce that values flexibility.

- Investors demanding shorter, more reliable ROI cycles.

- The rise of technology as the backbone of property transactions and management.

These startups are proving that real estate doesn’t have to be locked behind high capital or outdated systems. It can be fluid, digital, and profitable, all at once.

Why Zimmr Is the Most Strategic Investment of the Five

All five companies are important to Nigeria’s future, but Zimmr stands out for one reason:

it’s not just innovating within real estate , it’s creating an entirely new asset class.

Here’s why investors should pay attention:

- It’s built on mobility, not speculation.

People will always move , for work, trade, or family. That’s recurring, reliable demand. - It generates daily revenue.

Unlike land banking or long-term rentals, Zimmr earns income every day beds are occupied. - It has a low entry threshold.

With ₦1 million, investors can secure equity — a rare blend of affordability and tangible ownership. - It’s scalable.

Once one terminal model succeeds, expansion across Nigeria’s transport network becomes seamless.

Conclusion

The Nigerian real estate market is at an inflection point. It’s not about who owns the most land, it’s about who builds the most relevant solutions. If you’re looking to invest not just in real estate, but in the future of it, then Zimmr is one name you’ll want to keep on your radar , or better yet, in your portfolio.

To learn more or request investor documents, visit zimmr.co